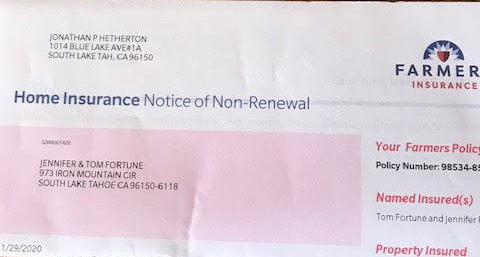

Non-renewal came in the mail

The topic of wildfire is constantly a recent headline here in the state of California. As we all know, It is very sad to see families lose everything they own. Our unfortunate reality is we will all be paying for these tragedies with the current increase in homeowner insurance. As of recent many of us here in the Tahoe Basin are getting notices of non-renewal. Mine came last week from Farmer’s Insurance-just in time for Valentines Day. I call it my love letter. A Non-renewal simply means we now are being forced into the option called the CA Fair Plan.

The CA Fair Plan-How ironic is that name?

In my mind there is nothing fair about the CA Fair Plan. My local insurance agent from Farmers told me it is the only option I currently have to cover for fire (interior and wildfire). So now I need two policies. One for fire and one for everything else. I’m surprised since my home received an A+ from the local fire department for defensible space, there is a fire hydrant across the street, I live within a half mile from a fire department and I aslo live in the Angora Bun area.

My homeowners insurance is going up this year almost 100% because of my Non Renewal

My personal home’s wildlife danger is rated by the state from a fire score map and anything above a 3 is considered very high. Being a Realtor I asked my mortgage guy Ron Yokotake, what if people can’t pay these increases and he replied “we start the foreclosure process”. This high cost increase is due solely to the high costs of the CA Fair Plan. These CA Fair Plans are very expensive.

File a complaint with the CA Department of Insurance

This paragraph I recommend as homeowners we can try and save our homes from wildfire with good defensible space and making sure we have adequate insurance coverage. Our local fire department does free defensible space inspections. Also, I was told we should all file complaints with the CA Dept. of Insurance.

I hope the state of CA will have some positive influence over the insurance companies in the near future. This isn’t happening to all homeowners in Tahoe, for instance my neighbor has been with AAA for 27 years and hasn’t been dropped.

Adequate Insurance Coverage

In conclusion, keep in mind to also have adequate coverage to rebuild your house. My local insurance agent who I recommend is Jon Hetherton with Farmers. I would be happy to provide his contact info. Recently, a local general contractor, Jared Clark, told me that it costs a minimum of $300 a square foot to build a quality home here in South Lake Tahoe.

For all of your real estate needs here in South Lake Tahoe, CA or NV please contact me. Jennifer Fortune, jfortune@chaseinternational.com, 530-318-9286 realestateonlaketahoe.com

Leave a Reply